travel nurse state taxes

41 states have income tax. Ad File 1040ez Free today for a faster refund.

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Jan 29 2021.

. My question is would ONLY the income earned in Ca. Travel nursing and taxes can seem tricky so if you feel uncomfortable go to a professional to help answer all of your questions. Nursing explains that every state has different laws for filing taxes but travel nurses must file a non-resident tax return in every state they have worked in as well as the state thats your permanent tax home.

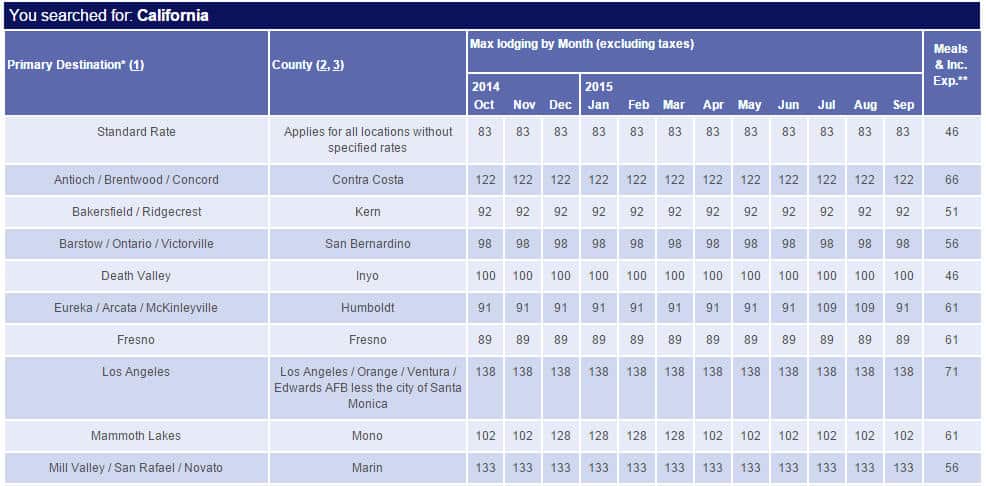

Since travel nurses are working away from their tax home certain companies must. Not just at tax time. 250 per week for meals and incidentals non-taxable.

States have a state income tax but alaska florida nevada new hampshire south dakota tennessee texas washington and wyoming dont. I live in Florida and receive a retirement pension form the military. It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable.

The only condition to qualify for Tax-Free income is that the traveler must be working in a state that is not their tax home. One frequent mistake traveling nurses make is not applying for state income tax credits on tax returns filed in your tax home state. 1 A tax home is your main area not state of work.

It helps organizations assess work authorization and visa needs. Be sure to carefully read and file the tax return for your tax home state as that is where you will apply for those credits. If a travel nurse is not qualified to receive tax-free stipends the rate will be the similar 40-80hour but taxes will apply to the whole amount.

Hi there I am considering travel nursing to California but I do not know how the state income tax works there. Travel nurse tax tips. Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses.

At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. Be subject to Ca. FREE REVIEW OF PREVIOUSLY FILED TAX RETURNS.

And how this distinction is the main source of confusion among travelers recruiters and staffing agencies who try to determine whether travel reimbursements. Many states are still expecting residents to file by April 15th and still assessing penalties for those who file late. As we began our last piece on nursing taxes.

I could spend a long time on this but here is the 3-sentence definition. Crisis Contracts and Travel Nurse Tax Changes. You may be subject to state income tax in both the state of your permanent residence and the states where you had travel nurse jobs.

Smith advises travel nurses keep a receipt book to help them make tax preparation a little easier by having all of their paperwork in one. You will still make more money than the average staff nurse in most states. Also nurses are free to go anywhere in their breaks.

State income taxes or would my retirement pension also be subjected to Ca. The staffing firms finance department will be able to provide you with a clear breakdown that you can use for the filing of your travel nurse taxes. The most prominent Travel Nurse Tax Deductions are Tax-Free Stipends for Housing Meals Incidentals Travel Reimbursements and Professional Development Costs.

State returns which are often the more complex aspect of filing taxes for travel nurses are subject to different due dates. Another common mistake is not maintaining a clear tax home. Tax-Free Stipends for Housing Meals Incidentals.

The EY Travel Risk and Compliance integration with SAP Concur solutions helps reduce risk. This means travel nurses can no longer deduct travel-related expenses such as food mileage gas and license fees and the only way to recuperate this money is either through a stipend from your travel agency or in the form of reimbursements for expenses you actually. Deductions Make It Possible to Earn More Money.

Presently Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming wont tax your travel nurse salary. But I Didnt Work Thereand similar comments about travel nurse taxes and state tax returns. Alaska Washington Wyoming Nevada South Dakota Tennessee Texas Florida New Hampshire USVI and the District of Columbia for nonresidents.

Here is an example of a typical pay package. It is common practice for states that charge income tax to tax travel nurses even though they might not be permanent residents of that state. Estimated taxes or quarterly taxes should be 25 of the tax you expect to owe for the year.

How many states have state income tax. 20 per hour taxable base rate that is reported to the IRS. If I am a resident of any of these states or the USVI I am not exempt from paying state taxes in the states that I work.

And then there are travel nurse taxes. State income taxes. While working as a travel nurse adds an additional layer of tax challenges it can also be a great way to gain a tax advantage.

At the same time the work state will tax the income earned there. Also nurses are free to go anywhere in their breaks. The following states and jurisdictions do not have an income tax.

Travel nurses are granted tax-free stipends and travel nurses save up to 10k annually compared to permanent nurses. This is the most common Tax Questions of Travel Nurses we receive all year. MyIdea Travel Nurse State Taxes.

States have a state income tax but Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming dont. In previous articles I have pointed out the difference between a permanent residence and a tax residence. Here are some categories of travel nurse tax deductions to be aware of.

A blended rate combines an hourly taxable wage such as 20 an hour with your non-taxable reimbursements and stipends to give you a higher hourly rate. The only way to ensure that employees comply with state- or country-specific tax and immigration requirements is to implement a fully integrated solution into the travel booking workflow. Travel nurse taxes are due on April 15th just like other individual income tax returns.

You will also need to pay estimated taxes since there are no tax withholdings for independent contractors. Travel Nurse Tax Deduction 1.

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

Travel Nurse Tax Deductions What You Need To Know For 2018

Trusted Event Travel Nurse Taxes 101 Youtube

Talking Travel Nurse Taxes The 50 Mile Rule The Gypsy Nurse

How Do Taxes Work For A 1099 Travel Nurse Clipboard Academy

Tax Deductions For Nurses Rn Lpn Np More Everlance

Travel Nurse Tax Deductions What You Need To Know For 2018

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Travel Tax The Travel Nurse S Guide To Taxes Travel Nursing

Travel Nurse Tax Pro Home Facebook

How To Calculate Travel Nursing Net Pay Bluepipes Blog

State Tax Questions American Traveler

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

How To Make The Most Money As A Travel Nurse

Travel Nurse Tax Guide Travel Nursing Nurse Guide Nursing Jobs